The role of consumers is often overlooked within circular economy discussions, however, there is an increasing amount of evidence that shows many people are aiming for a more sustainable lifestyle and striving to have a more positive impact on the planet. As a result, consumers expect companies to take more action, and demonstrate more responsibility towards climate change. We show you, based on studies, what the industry can do to support consumer interest in closing the circular value chain.

Our comprehensive analysis of the role of customers in circular business models includes:

- Consumer trends and sustainability - the figures

- Circular opportunities in the outdoor and sporting industries

- Achieving circularity through durable textiles

- Product maintenance and the circular economy - the opportunities, challenges, and how to address them

- Reuse models in the outdoor industry - the opportunities, challenges, and how to address them

- Outdoor and sporting industry rental models and the circular economy - the opportunities, challenges, and how to address them

Consumer trends and sustainability - the figures

Consumers have the purchasing power, and they ultimately decide whether a product is appropriately cared for, repaired, resold, or put into landfill. This makes consumers perhaps the most important factor in the circular value chain. Understanding consumer behaviors and attitudes towards sustainability can help companies develop successful circular economy activities that will resonate with the consumer in the most impactful way.

Research by the global trend company the Foresight Factory gives several insights into the attitudes of citizens across a range of topics and sectors in respect to a sustainable lifestyle:

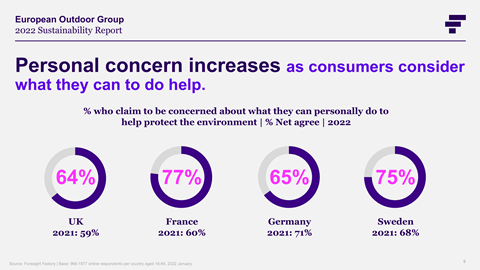

- There is a high concern about climate change, and 43 percent of European consumers say the Covid-19 pandemic has encouraged them to live more sustainably. In addition, between 2021 and 2022 there has been an increase in consumers feeling more personally responsible for making changes.

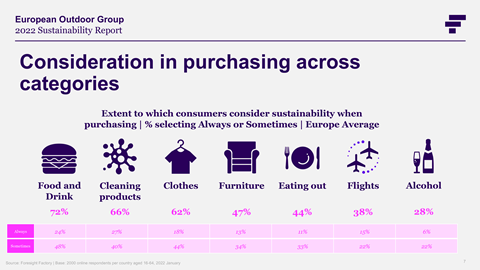

- Purchasing decisions based on sustainability factors differ across categories, with the top 3 being food and drink, cleaning products, and clothes.

- Consumers expect companies to take more responsibility for environmental impacts and there are a range of factors which are important to them.

- Despite consumers’ best intentions, there are still barriers to shopping sustainably.

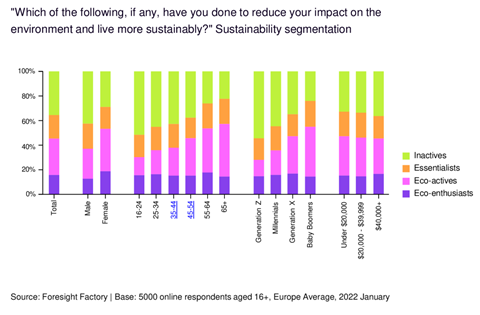

- The most environmentally friendly segment behaves similarly, regardless of demographic.

In conclusion, consumers are generally highly concerned about climate change impacts and what they can personally do to help.

Circular opportunities in the outdoor and sporting industries

Circularity is a complex concept and while a common definition is still developing, there are key elements that are agreed upon. Thought leaders Cradle to Cradle and the Ellen MacArthur Foundation share the goal of extending resource life, and focus on implementation strategies such as reuse, servitization (connecting and adding a service to a product), and designing for longevity and repair. There are also preventive strategies, such as functional replacement (e.g. mobility as service models replace the need for individual car ownership) and dematerialization – using less or no material to deliver the same level of functionality (e.g. by digitizing, or selling a product electronically or virtually).

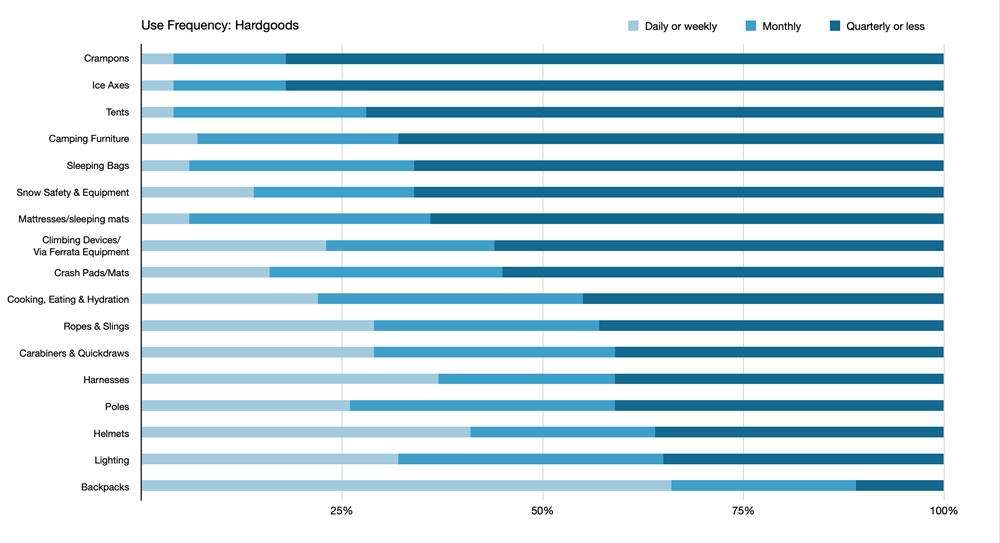

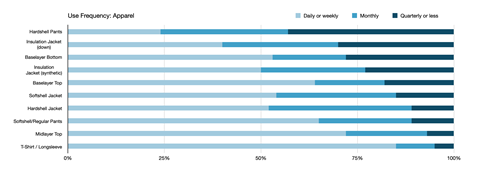

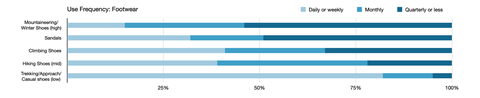

In 2020, the European Outdoor Group carried out a citizen survey to try and understand circular-specific behaviors within those who regularly engage in outdoor activities1. The study investigated measures such as frequency of use and how long garments are kept (as a measure of durability), as well as other circularity indicators. The data provides many insights into consumer behavior which inform the recommendations here.

Achieving circularity through durable textiles

Less than an estimated 1 percent of textiles are recycled2 – making this a very important piece of the circularity puzzle. Upcoming European policies around mandatory textile waste collection form part of the EU Waste Framework Directive. However, while there are several promising and newly emerging recycling technologies, there are still gaps in commercial availability at scale, and challenges remain around textile sorting. As such, the following section will not discuss end-of-life recycling for circularity, but will instead focus on opportunities that exist to prolong the lifetime of textile products.

The outdoor and sportswear industries have a head start when it comes to prolonging the lifetime of their garments. Due to performance requirements, they are generally made of high-quality materials and are well constructed. This provides innate durability, meaning the products can be kept in use for a long time, and also offers an ideal foundation for circular activities such as repair, reuse, and rental.

Product maintenance and the circular economy

Care, maintenance, and repair directly prolong the product lifetime by mending a small part of a product that is otherwise still functional. The simple re-application of water repellent coatings is maintenance, and is a circularity activity which extends product life and helps consumers to keep using their products for longer. Consumer satisfaction will also likely be increased with longer lasting products.

Opportunities

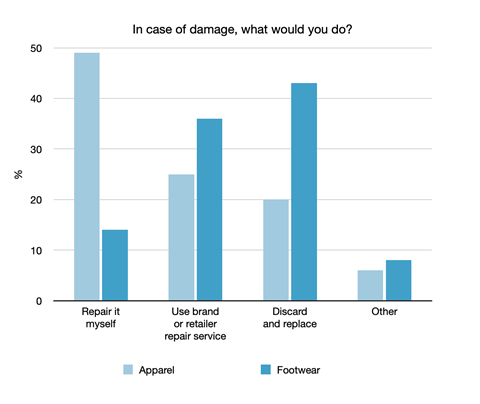

An EOG survey on end-of-life and recycling practices3 found that 72 percent of outdoor brands are already offering repair services. According to the EOG Citizen Survey, in the case of product damage, 68 percent of respondents are repairing apparel themselves, while 35 percent are using professional services. For footwear, 19 percent of respondents are repairing items themselves, while 50 percent are using professional services; suggesting that boots might be more difficult for consumers to repair, and therefore may provide the biggest opportunity for expanded repair services.

Other opportunities include:

-

Creation of additional revenue streams via service and repair kits.

-

Creation of additional revenue streams from washing services and the sale of care packages.

-

Opportunity to carry out inspections during a service, to reassure consumers that products are still high quality.

Challenges

-

Potential environmental impacts from extra chemicals.

-

Energy requirements for washing, reproofing, and drying garments.

-

Additional GHG impacts of transport and packaging.

-

Waste created from repairs.

-

Time and cost factors intensify compared to purchasing a new product.

-

Additional staff and skills required to handle the washing operations and quality inspection and repairs.

-

Consumer concerns about quality.

Addressing the challenges

-

Retailers could provide maintenance and repair services e.g. where a ski service is offered in the winter, they could provide hiking gear maintenance and repairs in the summer.

-

Brands/retailers could host workshops on maintenance and repair.

-

Maintenance and repair self-service stations could be offered in stores for simple product care, such as boot waxing.

-

Staff should be trained to provide appropriate guidance on the care of products.

-

Creation of blogs/leaflets/manuals with information on product maintenance and DIY repair tutorials.

-

Use unrepairable products for other product repairs and redesign.

-

Place appropriate facilities or drop off/collection points in locations where communities meet, such as climbing gyms.

-

Use local tailors and shoemakers for repairs, to decrease transportation related emissions.

Reuse models in the outdoor industry

Reuse includes all activities where products are sold or donated to be used by another person after the initial purchase. Reuse is considered to provide the highest positive environmental impact, particularly when global warming and CO2 emissions are considered. It is also the most effective way to combat over consumption and production, by minimizing the need for new production and natural resource extraction.

Opportunities

-

Over 40 percent of Generation Z and Millennials have shopped for second-hand clothing in the past 12 months4.

-

The pre-loved market is the fastest growing channel, and will have an estimated 18 percent market share by 20305.

-

Based on the EOG Citizen Survey, 1 in 4 discard their outdoor clothing, and 15 percent their footwear, due to fit and size issues, creating an opportunity to increase convenient channels for resale.

-

Donations create positive social impacts and additional revenue streams.

-

Reuse provides consumers with a sense of making a positive impact.

Challenges

-

The additional carbon footprint and packaging if products need to be sent back to be resold.

-

Consumer concerns about safety and hygiene.

-

Based on the country, a second-hand dealers’ license may be required.

-

Competition from established peer-to-peer channels such as Facebook Marketplace or eBay.

Addressing the challenges

-

Lightly used products discarded due to size and fit issues could be traded by brands, retailers, and other actors such as climbing gyms. Some US companies, including Patagonia, REI and Outdoor Gear Exchange, do just this, where lightly used products can be brought or sent to the retailer, who then sells these in exchange for store credit.

-

Peer-to-peer platforms and donations provide reuse channels for heavier used products with less resale value.

-

Companies can collect products to be donated for charities, mountain rescue teams, scout groups, or other organizations who take groups outdoors.

-

Flea markets are an alternative way to sell used gear and can be organized by retailers, or as a side activity during sports and outdoor events.

-

Technology such as digital product passports could give consumers information on how many times the product has been used, washed, or serviced; reducing hygiene and/or safety concerns.

Outdoor and sporting industry rental models and the circular economy

Rental is a circular activity where the consumer does not retain ownership of the product but pays for the product as a service. There are three common rental types:

-

product service systems (PSS) or subscription models, where consumers subscribe to use a product for a fixed duration, with monthly or weekly fees.

-

short term rentals with a fixed price, for products that are only needed for a short time, such as skis or mountain bikes for a holiday.

-

rent to buy, where consumers can use the rental period to test the product (with the rental price deducted from the product price if they decide to purchase)

Short term rentals can increase usage rates for products that might otherwise be used occasionally. This increased usage per product can reduce overall production rates.

There are different ways to do rental, including online platforms (C2C, B2C, B2B), brand websites, and local shops.

Opportunities

-

Subscription models can help to reach new consumer segments.

-

Subscription models generate continuous cash flow, which increases revenue forecast accuracy.

-

Rented products can retain resale value, and hence a total lifecycle value which is higher than a product that is sold once.

-

Renting gives brands an opportunity to test products prior to official launch, and for consumers to test the product before committing to buy.

-

Renting offers consumers more convenience and a simpler way of living.

-

Renting can create increased consumer engagement and provides frequent feedback points.

Challenges

-

May contribute to increased production and waste generation if rental is used to provide access to newest models each year.

-

Increased packaging requirements if products need to be delivered to users.

-

Transportation and maintenance requirements impact the overall environmental impacts if products are delivered to users6.

-

Rental is an asset heavy business model which can create challenges with upfront product costs, and profits realized at a later stage.

-

Rental models require specific software to manage the rentals, subscriptions, and product tracking.

-

Product life value is impacted by maintenance costs such as repair, washing, and reproofing. These require either internal skills and possible new personnel, or new partnerships.

-

Consumer concerns about safety and hygiene.

-

There are few insights into precisely what products consumers are most likely to rent.

Addressing the challenges

Recent studies suggest that rental models differ greatly in terms of potential positive and negative impacts, depending on the business model and product category. There are three main points to consider when ensuring rental models deliver the intended positive impacts with minimal rebound effects:

1) Products that are infrequently used are best suited for rental. The key consideration is that the rental model should increase the usage of one product among several users, which in-turn decreases the overall new production requirements.

The EOG Citizen Survey suggests that:

-

Hardgoods are the most infrequently used products in the outdoor industry. Winter mountaineering and camping equipment are used quarterly or less, and likely most suited for rental models.

-

Outdoor apparel is used very frequently and there is little room to increase the usage through rental programmes.

-

Hardshell pants and down insulation jackets are least frequently used, and these products might be more suitable when offered as a package, together with skis or winter mountaineering equipment.

-

In footwear, winter & mountaineering boots are the least frequently used products.

-

Children’s clothing and equipment might be more suitable for rental due to the need to upgrade sizes frequently.

2) Keep the service as local as possible. Transportation and deliveries of products should be kept at minimum, as these have the potential to significantly increase the overall environmental impacts of a product. Rental locations should ideally be located near where the product is being used, such as ski resorts, camping sites, or national parks.

3) Use circular packaging providers such asRePack, the BOX and Returnity when products need to be delivered and returned via mail.

Additionally, information technology such as digital product passports can be used to respond to safety and hygienic concerns. The information can provide information on how many times the product has been used, washed, or serviced.

It’s clear that there are many challenges facing both the environment and the industry, but these really do present opportunities for new ways of doing business and thinking about circularity in the ecosystem as a whole. Consumer willingness to change is there; it’s up to brands to make this possible.

1 European Outdoor Group, Citizen Survey, Lifetime of Outdoor Apparel, Footwear and Gear. 2020. Data available upon request.

2 European Commission, Directorate-General for Communication, Circular economy action plan: for a cleaner and more competitive Europe, Publications Office of the European Union, 2020, https://data.europa.eu/doi/10.2779/05068.

3 European Outdoor Group, Understanding end-of-life and recycling practices. Part 1: Future goals and barriers within different tiers of the textile supply chain. 2020 https://bit.ly/3gih0m4.

4 ThredUp. 2021 Resale Report. 2020. Available from: https://www.thredup.com/resale/#transforming-closets.

5 Levänen, J., Uusitalo, V., Härri, A., Kareinen, E. and Linnanen, L., 2021. ”Innovative recycling or extended use? Comparing the global warming potential of different ownership and end-of-life scenarios for textiles.” Environmental Research Letters, 16(5).

6 Piontek, F.M., Amasawa, E. and Kimita, K., 2020. Environmental implication of casual wear rental services: case of Japan and Germany. Procedia CIRP, 90, pp.724-729.

Written by Katy Stevens, Head of CSR and sustainability, and Pauline Shepherd, Head of Market Insights, both from the European Outdoor Group (EOG). The EOG is an international trade association supporting the outdoor sector on a range of pre-competitive issues and topics including CSR and market research and analysis. It adds value to members, facilitates pre-competitive collaboration, and promotes industry growth. Its membership represents the European outdoor value chain, and provides market insights for the sector, collaborative CSR & sustainability opportunities, key trade events and shows, external representation of the industry on key issues, and meaningful sector communication.